|

November (2023)

Hexpol AB: Acquires Star Thermoplastic Alloys and Rubbers, Inc. Link...

Hexpol has acquired TPE Compounder Star Thermoplastic Alloys and Rubbers, Inc. The acquisition is in line with Hexpol's growth strategy enabling it to enter the American TPE market through a well established company with a strong offering.

February (2022)

Hexpol AB: Restructuring UK Operations Link...

Hexpol is in consultation for a planned restructuring of its UK operations which will see its Lydney operation combined with its Manchester operation with business operations continuing in Manchester only.

September (2021)

Hexpol AB: Hexpol TPE Expanding in Sweden Link...

HEXPOL TPE has announced a 57 Million SEK investment at their company in Åmål, Sweden, to support increasing demand and evolving market requirements. The Swedish company specialises in TPE materials for sensitive and regulated applications such as medical devices, toys, consumer, automotive and food contact. Sustainability and biobased materials are also driving their strategy. A new production hall is being constructed, dedicated to medical production, with strict cleanliness, traceability, and reproducibility controls. It has been designed to minimise contamination risks and will house a new twin-screw compounding line with gravimetric feeders and advanced monitoring systems adopted for medical production. The project is targeted for completion by autumn 2022.

August (2021)

Hexpol AB: Develops Firsts TPE with Recycled Content for Automotive Interiors Link...

Hexpol TPE has expanded its range of TPE materials with recycled content to include Dryflex Circular TPE grades which have been tested for odour and emissions performance in automotive interiors. The material is currently being approved by a German car manufacturer. The recyclate is from waste streams during post-industrial manufacturing processes, originating from injection moulding sprues or edge trims in extrusions. The recyclates were selected due to their high levels of consistency and purity. With consideration of transportation and energy impacts, the recyclates are sourced in Europe. Dryflex Circular TPEs are produced at HEXPOL TPE’s European sites, which use 100% renewable electricity. The new Dryflex Circular TPEs can be used in various automotive interior applications such as inlay mats, cup holders, sealing lips and HVAC parts.

April (2021)

Hexpol AB: Acquires Spanish Compounder Unica Link...

Hexpol has agreed to acquire Union de Industrias C.A. (Unica) from a Spanish private equity firm. Unica is a custom compounder based in Spain which supplies into the automotive, construction and agricultural sectors.

March (2021)

Hexpol AB: Acquires VICOM Link...

Hexpol has acquired VICOM, a Spanish Polymer Compounder focused on the Wire and Cable market. Hexpol sees the wire and cable business as high growth due to the global electrication trend.

January (2021)

Hexpol AB: Fire at Hexpol's Jonesborough, TN, Compounding Plant Link...

A fire was reported on 7th January at Hexpol's Jonesborough, TN compounding plant. The plant compounds materials for the transportation, tire, industrial and rolls markets.

September (2020)

Hexpol AB: Launches Wire and Cable Compound Portfolio Link...

Hexpol Compounding Group has launched a comprehensive portfolio of wire and cable compounds based on high performance materials including VMQ, advanced rubber technologies, additives and TPEs. The wire and cable industry is a high growth market following trends in electrification and connectivity. This market is also witnessing increased regulations and standards for the protection of people and infrastructure. The portfolio includes silicone rubber materials, CPE, EPDM, NBR+PVC, CR rubber compounds, pigment and additive masterbatch, as well as thermoplastic, EVA, TPE and TPV technologies. Typical properties include halogen-free flame retardancy, low smoke and low toxicity. Materials are RoHS, SVHC and REACH compliant with grades designed to meet international cable standard such as EN50363 or IEC 60811. Bedding, insulation and sheathing materials are all part of the portfolio. Application areas include locations containing expensive or sensitive equipment, such as hospitals, airport, train and transport hubs, communication exchanges, power generation facilities and offshore platforms. With enhanced thermomechanical properties grades are available for telecommunication and electric cables, from high-to-low voltage.

August (2020)

Hexpol AB: Hexpol TPE Expands Range of Biobased TPEs Link...

International Polymer Compounding Group HEXPOL TPE have added more grades to their Dryflex Green family of Biobased TPE Compounds. The series now includes grades based on Styrenic Block Copolymer (TPS) and Thermoplastic Polyolefin (TPO) technologies, with amounts of renewable content to over 90% (ASTM D 6866-12) and hardness from 15 Shore A to 60 Shore D. Dryflex Green TPE compounds contain raw materials from renewable resources such as plant and vegetable crops. The biobased content can derive from various raw materials such as polymers, fillers, plasticisers or additives, coming from renewable sources such as products and by-products from agricultural that are rich in carbohydrates, especially saccharides.

January (2020)

Hexpol AB: 2019 Increased Sales Driven by Acquistions Link...

Hexpol group sales for 2019 increased by 13 percent, acquisitions and exchange rate fluctuations increased sales by 16 and 6 percent respectively. Organic sales decreased by 9 percent. The volume was higher overall, including the acquired operations of Kirkhill Rubber, Mesgo Group and Preferred Compounding. A North American restructuring programme was initiated after the Preferred Compounding acquistion which included the closing to two production units in the US during 2019 Q4. Lower organic volume was due to softer market demand strengthened by increased insourcing of basic compounds at some rubber compounding customers. When sales drop for customers with in-house mixing they tend to increase insourcing of compound. There was also a sharp decline in Tire & Toll compounding compared to the previous year.

RCCL Industry Analysis:

Analysis Snippet: Global & North American MRG Compounding Capacity Consolidations

Custom compounders account for a significant share of global rubber goods (MRG) compounding capacity. With continued acquisitions in the custom compounding segment it is useful to put some context around global and regional consolidation in the MRG compounding sector.

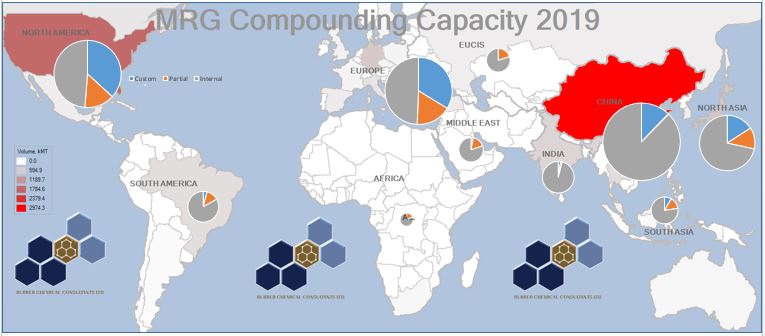

Figure 1 presents a summary of global MRG compounding capacity for 2019, broken down by region and country. The pie charts for each region are split into custom, partial and internal compounding shares. Custom compounding volume is derived from compounders supplying exclusively to external customers (converters). Partial compounding volume is for compounders that utilise compound for their own purposes and supply excess capacity to external converters. Internal compound is used solely for internal consumption.

The main MRG compounding regions are China (treated as a region due to its high compounding volume), North America, Europe, and North Asia. The most significant countries are China and the USA. It is clear from the pie charts that custom compounding is more prevalent in North America and Europe.

Figure 1 - Global Rubber Goods (MRG) 2019 Compounding Capacities and Types by Region

Herfindahl indices were calculated using the theoretical (not market adjusted) compounding capacity for each MRG company active in compounding. These capacities are based on MRG volumes and cover all MRG related market segments. Tire volumes were excluded.

It should be noted that the MRG sector has significant complexity, covering a wide range of industries, each with underlying segments and subsegments. Detailed analysis for industry specific sectors and segments is recommended as follow-on analysis.

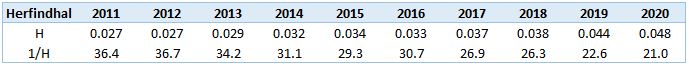

Table 1 presents global Herfindahl indices for all MRG compounding. The H values indicate a competitive landscape which is showing a steady consolidation from 2011 to 2020. The ‘effective’ companies (provided by 1/H) shows a steady decrease from 140 to 85.

Table 1 - Global MRG Compounding Herfindahl Indices All Compounding Types

Table 2 presents North American Herfindahl indices for all MRG compounding. The H values indicate an un-concentrated industry, with a trend towards higher concentration. The effective companies reduce from 36 to 21 over the time period studied.

Table 2 - North American Compounding Herfindahl Indices All Compounding Types

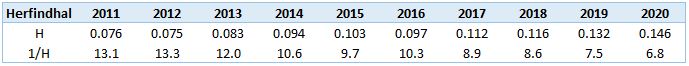

Table 3 presents North American Herfindahl indices for custom and partial custom compounding. The H values show a transition from low concentration to moderate industry concentration by 2020. The effective companies reduce from 13 to 7 over the time period analysed.

Table 3 - North American Custom and Partial Custom Compounding Herfindahl Indices

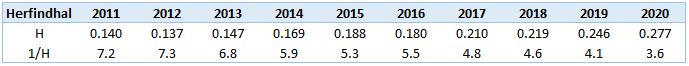

Table 4 presents North American Herfindahl indices for custom compounding only. This shows a transition from low, to moderate, to high concentration over the ten year period, with the effective companies reducing from 7.2 to 3.6.

Table 4 - North American Custom Compounding Herfindahl Indices

The above considerations have importance for chemical suppliers with a shrinking customer base and consumers with high volume leverage. The impact is more significant for commoditised products where supply competition is fierce and the consumer base is restricted through the increasing influence of major custom compounders. It is notable that the MRG sector as a whole has seen major players make strategic moves to differentiated products (and compounds) which are generally lower volume and higher value.

Further analysis for industry sectors, segments and subsegments, is available from Rubber Chemical Consultants. Please contact us for details.

November (2019)

Hexpol AB: Closing Kardoes Rubber Site by End 2019 Link...

Hexpol is closing its Kardoes Rubber site by the end of 2019. The closure announcement, coming shortly after the acquistion of Preferred Compounding, is part of an integration and restructuring of the business.

July (2019)

Hexpol AB: Acquires Preferred Compounding Link...

Hexpol has acquired Preferred Compounding from the Audax Group, a US based private equity firm. Preferred Compounding is a North American custom compounder serving the industrial, automotive, power and infrastructure markets in particular. Preferred Compounding had 2018 sales of approximately $240 million, having six facilities, five in the USA and one in Mexico.

October (2018)

Hexpol AB: Acquires 80 Percent of Shares in MESGO Group Link...

Hexpol has acquired 80 percent of the shares in MESGO Group. MESGO is an industry leader in high performance compounding using fluorcarbons and silicone rubbers.

September (2018)

Hexpol AB: Acquires Kirkhill Rubber Link...

Hexpol has acquired Kirkhill Rubber. Kirhill's Long Beach facility will remain operational. Production at Downey, California will be transferred to Long Beach and production at Athens, Georgia will be transferred to other Hexpol sites in the US, therefore the facilities in Downey and Athens are not included in the transaction.

Kirkhill specialises in aerospace, automotive, medical and other demanding industry segments.

October (2017)

Hexpol AB: TPE Expansion in Germany Link...

The investment includes the installation of a new twin-screw production line as well as investment in infrastructure, sub-systems and equipment to support further expansion of the business. The new line is expected to come on-stream in early 2018 and will add around 5000 tonnes per annum capacity, putting HEXPOL TPE’s global TPE capacity in excess of 80 000 tonnes per annum. The new line in Germany will increase capacity for the companies TPS, TPO and TPU based Thermoplastic Elastomer compounds, in particular growing demand from the automotive, consumer and footwear markets.

April (2017)

Hexpol AB: Acquires Valley Processing's California Facility Link...

Valley Processing, with a manufacturing facility in City of Industry, California, US, had a turnover of 34 MUSD in 2016. The acquisition is due to be finalised in April subject to certain conditions.

March (2017)

Hexpol AB: Acquires Trelleborg's Lesina, Czech Republic Compounding Unit Link...

Trelleborg Material & Mixing Lesina s.r.o, with a manufacturing facility in Lesina, Czech Republic had a turnover of 40 MEUR in 2016 and has around 125 employees. The main end-user segments are within automotive industry, general industry, building and construction.

June (2016)

Hexpol AB: Acquires UK based Berwin Group Link...

Hexpol has acquired UK based Berwin Group, a leading rubber compounder in the UK.

January (2015)

Hexpol AB: Reconfiguring Robbins Muscle Shoals Production Link...

Closing one mixing line and focusing on retreading products at this facility.

December (2014)

Hexpol AB: Acquires Portage Precision Polymers Link...

HEXPOL has acquired the business of Portage Precision Polymers Inc. from the founder Mr. Doug Hartley and his family. Doug Hartley started Portage Precision Polymers in 2002 and Portage Precision is today a well-known Rubber Compounder in the US market.

November (2014)

Hexpol AB: Acquisition of VIGAR Rubber Compounding Link...

HEXPOL has today acquired the VIGAR Rubber Compounding business within Grupo Vigar from the founders’ families. Vigar Rubber Compounding has more than 50 years’ experience of rubber compounding and is a well-known Rubber Compounder in the Spanish and German market.

August (2014)

Hexpol AB: Acquisition of Kardoes Rubber Link...

HEXPOL has acquired the business of Kardoes Rubber Co. from the founder Mr. Frank Kardoes and his family. Frank Kardoes started Kardoes Rubber in 1988 and Kardoes is today a well-known Rubber Compounder in the US market.

January (2014)

Hexpol AB: Expansion of Muller Kunstoffe TPE production Link...

Müller Kunststoffe, the German arm of the HEXPOL TPE group, will grow its TPE production with an additional line early in 2014. The group also announced plans to grow its technical centre with a new building at Lichtenfels for developing customised TPEs. The new line is forecast to increase TPE production by around 4,800 tonnes per annum. Specifically, it will increase capacity for the group’s Lifoflex and Dryflex TPE compounds. The range includes properties for halogen-free flame retardancy, conductivity, adhesion grades for multi-component applications, food contact grades and compounds offering improved compression set performance

|